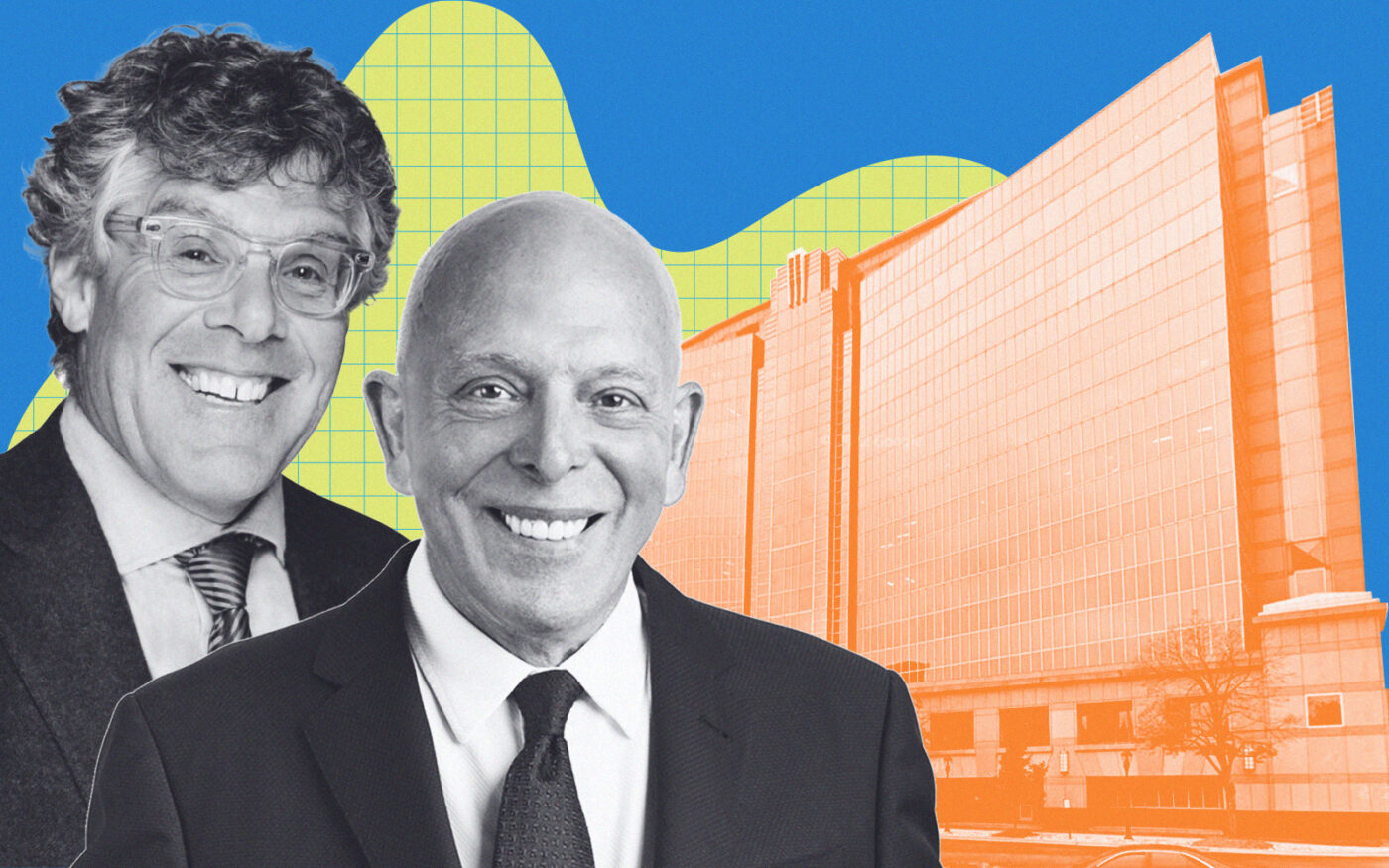

Hearn, GEM face $275M Loop office foreclosure

Hearn, GEM face $275M Loop office foreclosure

Trending

Nearly fully leased O’Hare office building to test demand for healthy assets

Canadian landlords’ property expected to sell at a loss but far more than their debt on the 12-story building

A Chicago office rarity just hit the market, and it’s expected to test demand for healthy assets in the city.

Calgary-based MDC Realty Advisors and an affiliate of Vancouver-based Nicola Wealth Management listed the 12-story building at 6250 North River Road, near O’Hare International Airport, CoStar reported. Cushman & Wakefield brokers Dan Deuter, Tom Sitz and Cody Hundertmark are marketing the property.

While plenty of office buildings have been listed and traded in Chicago recently, they are mostly buildings in financial distress or with high vacancy. Several have failed to fetch prices high enough to pay off previous loans tied to the buildings, hitting lender pocketbooks. But the River Road property is full enough to bring in plenty enough cash to pay off its debt even if it sticks its owner with a financial loss.

The 380,000-square-foot building is 93 percent leased, with a weighted average lease term of seven years, and while an asking price wasn’t listed, it is expected to sell in the range of $70 million, the outlet reported.

Food-and-beverage distributor Reyes Holdings is the building’s largest tenant, and Colliers International Real Estate leases 34,000 square feet.

The landlords bought the building in 2015 for $83 million, a little over $218 per square foot. They borrowed $49.5 million from Allianz Life Insurance for the purchase, and $41.5 million is still owed. The loan has been amended to mature in October.

For example, a venture led by Sigma Plastics Group founder Alfred Teo in March acquired the Schaumburg Towers office complex, at 1400 and 1450 American Lane, from Prime Finance, a lender that had taken the property in foreclosure from American Landmark Properties. The sale price was around $75 million, well below the $83 million debt on the property.

Other landlords of distressed properties in the Chicago area have surrendered them through deed-in-lieu of foreclosure deals with their lenders. A venture of Golub & Company and Alcion Ventures handed back the keys to the four-building suburban office complex Oakbrook 22 to lender Heitman in March. The partnership assigned its $57.2 million debt on the property to real estate firm Heitman, giving up its ownership, after the complex failed to attract a buyer.

—Rachel Stone

Read more

Hearn, GEM face $275M Loop office foreclosure

Hearn, GEM face $275M Loop office foreclosure

Blackstone, New York Life list distressed downtown office buildings

Blackstone, New York Life list distressed downtown office buildings

Farpoint in line to buy distressed Clark Street office tower

Farpoint in line to buy distressed Clark Street office tower